puerto rico tax incentives 2020

Corporation tax rate reduced from 30 to 25 effective 1 st January 2020. A nonresident company not engaged in a trade or business in Puerto Rico is generally taxed at a flat rate of 29 withheld on Puerto Rican-sourced profits and income including investment income rental income and capital gains.

International Tax Consulting International Tax Frost Law

Availability and eligibility vary may change without notice and are beyond the control of Harley-Davidson.

. The firm combines in-depth knowledge of the Egyptian economy tax regulations local business standards and customs with extensive coverage breadth of resources and quality assurance. PwC Egypt has over 350 partners and staff and is an integral part of PwCs growing network in the Middle East region. Welcome to the Shell Tax Contribution Report which aims to provide easily accessible and detailed information on Shells corporate income tax payments for 2020.

This report builds on the information Shell discloses in its Annual Report and Accounts Sustainability Report and Payments to Governments Report. However the withholding tax rate on dividend payments to non-residents has been increased from 10 to 15. Other tax credits and incentives.

The 15 tax rate for companies operating a. Federal tax credit may be 10 of the cost of the qualified vehicle up to 2500. The various tax incentives for new listings or introductions on an approved securities exchange have been eliminated.

Eligibility and amount of credits and rebates depend on your personal situation. The rates of income tax applicable to an individual for the 2020 charge year are as follows. Potential government incentives are identified for informational purposes only.

100 tax exemption from Puerto Rico income taxes on all short-term and long-term capital gains. The GDP growth rate in 2020 was 36. Under the Income Tax Act Zambia has a source-based system for the taxation of income.

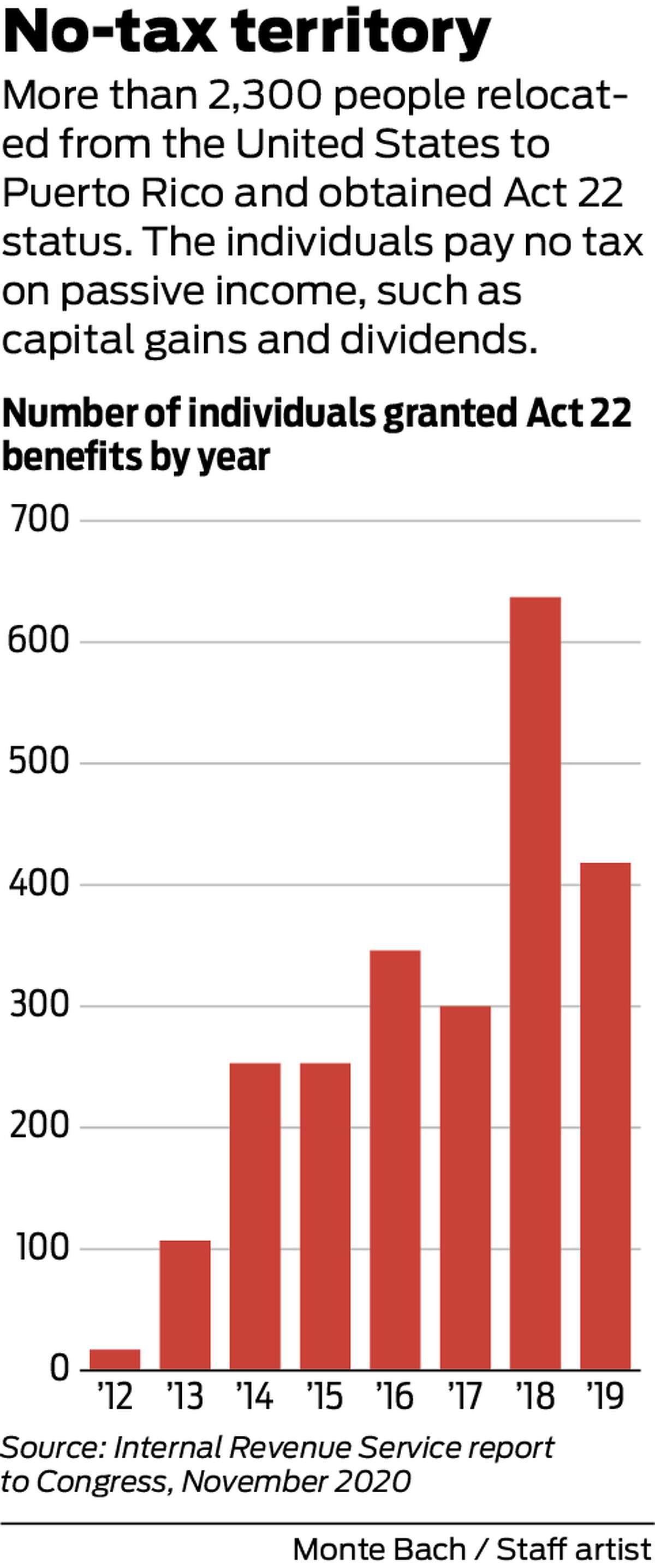

Just keep in mind that to qualify for these generous incentives you must become a bona fide resident of Puerto Rico which involves spending the. Taxable income ZMW Rate of income tax Up to 54000. 100 tax exemption from Puerto Rico income taxes on all cryptocurrencies and other crypto assets.

Move To Puerto Rico And Pay Zero Capital Gains Tax Premier Offshore Company Services

Puerto Rico Has A New Tax Incentives Code

Guide To Income Tax In Puerto Rico

What Logan Paul S Move To Puerto Rico Means Beyond The Tax Breaks

Oversight Board Certifies Fiscal Plans For Pridco Cossec 10 Towns News Is My Business

Puerto Rico Has A New Tax Incentives Code

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Island Of Enchantment Beckons San Antonio Lawyers Mikal Watts Thomas J Henry

Puerto Rico Has A New Tax Incentives Code

Puerto Rico Island Of Enchantment Beckons San Antonio Lawyers Mikal Watts Thomas J Henry

Why You Should Invest In Solar Energy Relocate To Puerto Rico With Act 60 20 22

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

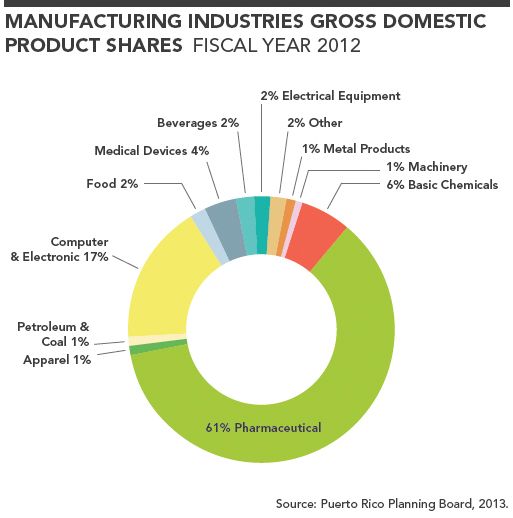

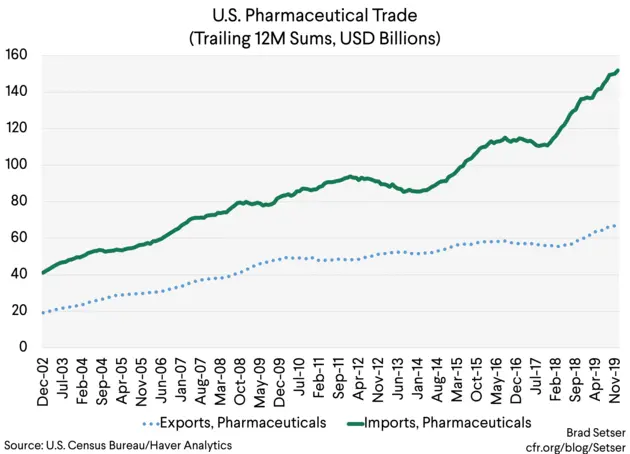

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

Guide To Income Tax In Puerto Rico

Puerto Rico Has A New Tax Incentives Code

![]()

Puerto Rico Incentives And Economic Reliefs To Address Covid 19

Why Puerto Rico Meet The Team Puerto Rico Real Estate Agents

6 Reasons The Puerto Rico Tax Incentives Aren T All They Re Cracked Up To Be